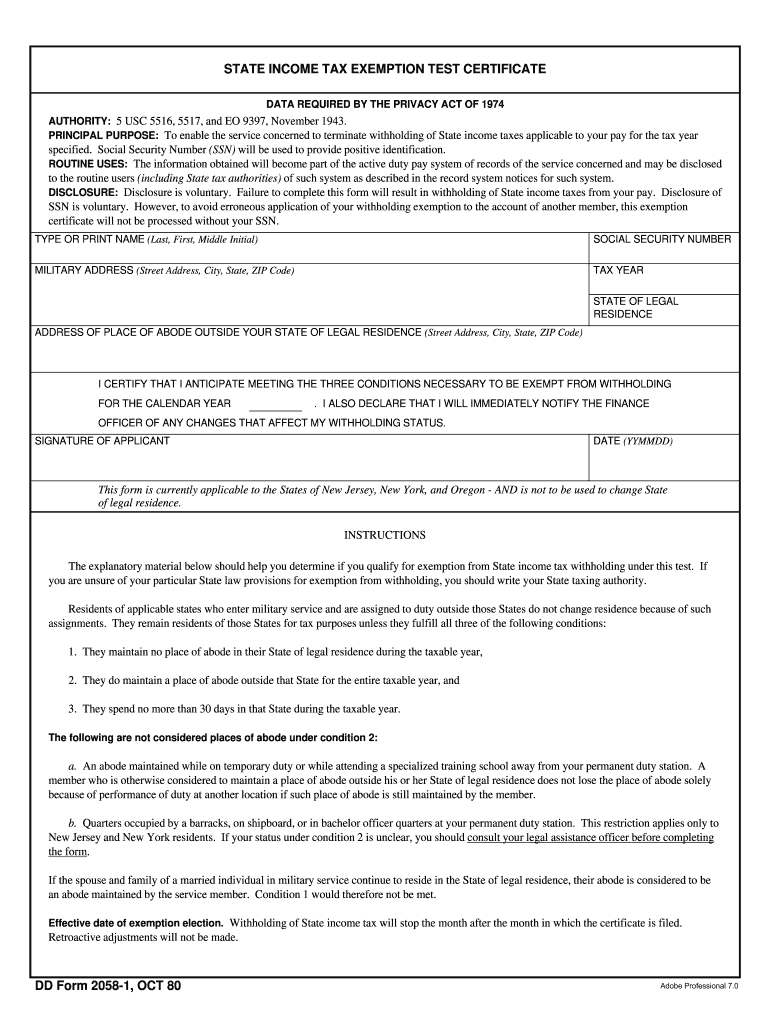

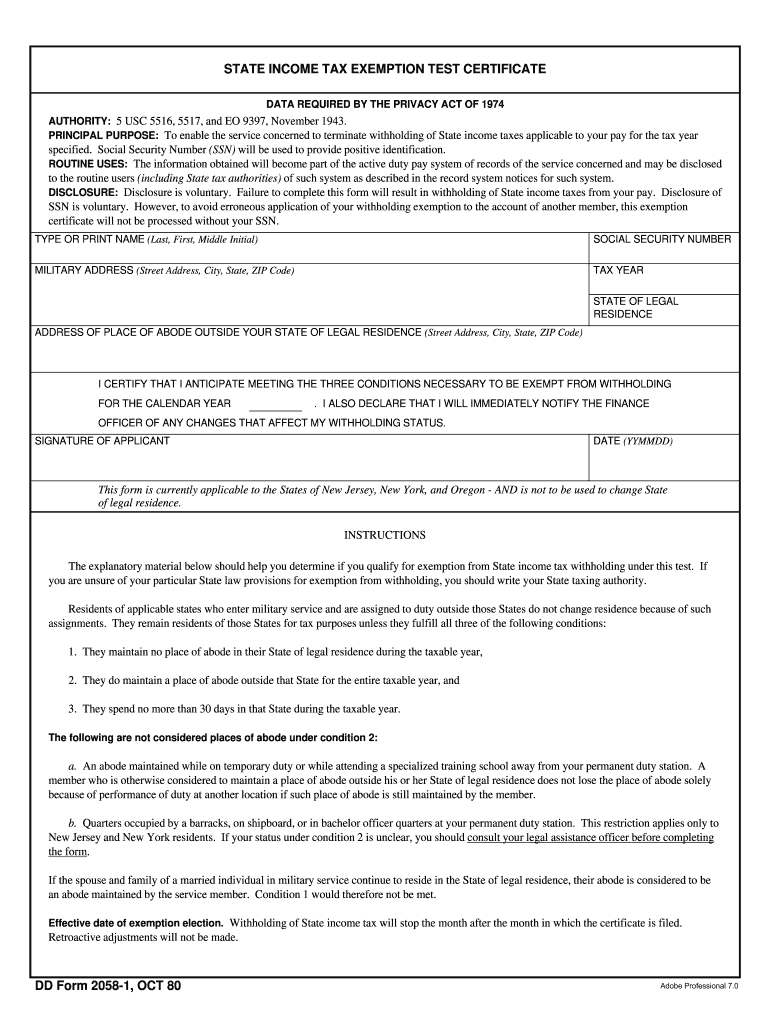

DD 2058-1 1980-2024 free printable template

Show details

If you are unsure of your particular State law provisions for exemption from withholding you should write your State taxing authority. Residents of applicable states who enter military service and are assigned to duty outside those States do not change residence because of such assignments. If your status under condition 2 is unclear you should consult your legal assistance officer before completing the form. If the spouse and family of a married individual in military service continue to...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your form states military form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form states military form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form states military online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit state form military. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form states military

How to fill out state income tax exemption:

01

Gather all necessary forms and documents, including your state tax return form and any supporting documentation such as W-2 forms or 1099s.

02

Review the instructions provided with the state tax return form to understand the specific requirements for claiming an exemption.

03

Determine if you are eligible for a state income tax exemption. Exemptions are typically available for certain individuals such as low-income earners, senior citizens, or individuals with specific circumstances or disabilities.

04

Fill out the required information on the state tax return form accurately and completely. This may include providing your personal information, income details, and any relevant exemptions or deductions you qualify for.

05

Attach any necessary supporting documentation to your state tax return form. This may include copies of W-2 forms, 1099s, or other proof of income or expenses.

06

Double-check your completed state tax return form for any errors or omissions. Ensure that all calculations are accurate and that you have included all required information.

07

Sign and date your state tax return form before submitting it. Follow the instructions provided on where and how to submit your completed form.

08

Keep a copy of your completed state tax return form and all supporting documents for your records.

Who needs state income tax exemption:

01

Individuals whose income falls below the taxable threshold set by the state may need a state income tax exemption.

02

Senior citizens who meet specific age and income criteria may be eligible for a state income tax exemption.

03

Individuals with disabilities or specific circumstances such as being legally blind or having dependents with disabilities may need to claim a state income tax exemption.

04

Members of certain professions or occupations that qualify for specialized state income tax exemptions, such as military personnel, educators, or first responders, may need to apply for these exemptions.

05

Individuals experiencing financial hardship may need a state income tax exemption to alleviate their tax burden.

06

Certain states provide income tax exemptions for specific situations such as disaster victims, foster parents, or individuals involved in renewable energy initiatives. These individuals would need to claim the respective state income tax exemption.

Fill dd income : Try Risk Free

People Also Ask about form states military

Should I claim exemption on tax form?

What is the difference between a w9 and tax exemption certificate?

How do I get a tax exemption certificate in USA?

How do I claim exemption on my tax form?

What is the tax exemption form for California?

What does it mean to claim exemption on tax form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What information must be reported on state income tax exemption?

The amount of income that is exempt from state income tax will vary depending on the state. Generally, the information that must be reported includes the taxpayer's name, Social Security number, filing status, and any income that is exempt from state income tax.

When is the deadline to file state income tax exemption in 2023?

The deadline to file state income tax exemption in 2023 is April 15, 2023.

What is the penalty for the late filing of state income tax exemption?

The penalty for late filing of a state income tax exemption varies from state to state. Generally, the penalty for late filing of a state income tax exemption is a late fee. The late fee is typically a percentage of the amount of taxes due, ranging from 5 to 25 percent. Contact your state's tax department or office for more information on the exact penalty for late filing of a state income tax exemption.

What is state income tax exemption?

State income tax exemption refers to an allowance or reduction in the amount of income on which an individual or household is required to pay state income tax. It is typically provided by state governments to certain categories of taxpayers, such as senior citizens, veterans, low-income earners, disabled individuals, or individuals with specific types of income. The exemption allows them to exclude a portion or all of their income from state income tax calculations, reducing their overall tax liability. The specific eligibility criteria and the extent of the exemption vary from state to state.

Who is required to file state income tax exemption?

The individuals who are required to file state income tax exemption vary by state. In general, individuals who meet certain income thresholds set by their respective state and have taxable income are required to file state income tax returns. Additionally, individuals with specific exemptions or deductions may also be required to file. It is important to consult the specific guidelines and regulations of your state tax authority to determine who is required to file state income tax exemption.

How to fill out state income tax exemption?

To fill out a state income tax exemption, you will typically need to follow these steps:

1. Obtain the necessary forms: Visit your state's official tax website or contact the state tax authority to obtain the specific form for claiming an income tax exemption.

2. Read the instructions: Carefully read the instructions provided with the exemption form to ensure you understand the requirements and eligibility criteria.

3. Provide personal information: Enter your personal information, such as your name, Social Security number, address, filing status, and any other required identification details.

4. Determine the specific exemption: Identify the specific type of exemption you are claiming. Common exemptions may include dependents, disabilities, homeowners, veterans, or senior citizens.

5. Gather supporting documents: Collect any necessary supporting documents that are required to prove your eligibility for the exemption. This may include birth certificates, adoption papers, medical reports, property ownership documents, military discharge papers, or any other documentation specified by your state.

6. Calculate and document your income: Provide accurate and complete details about your income sources, which may include wages, salaries, self-employment income, rental income, investment income, and any other taxable income.

7. Calculate and document your deductions: Determine your eligible deductions, such as mortgage interest, student loan interest, medical expenses, property taxes, charitable contributions, or any other deductions allowed by your state.

8. Complete the form: Fill out the exemption form by following the instructions and accurately entering the requested information. Double-check all entries for accuracy, as mistakes could delay processing or potentially trigger an audit.

9. Submit the form: Once you have completed the form and attached all necessary supporting documents, submit it to your state's tax authority by mail or electronically, according to their instructions.

Remember to consult with a tax professional or review your state's tax website for specific guidance related to your individual circumstances, as each state's tax laws and forms may vary.

What is the purpose of state income tax exemption?

The purpose of state income tax exemptions is to provide certain individuals or groups with relief from paying income taxes to the state government. These exemptions are typically granted for specific reasons such as promoting economic development, attracting businesses or industries, encouraging investment, supporting charitable activities, or assisting low-income individuals or families. By exempting certain income or individuals from state income taxes, governments aim to provide financial incentives, alleviate burdens, or address specific needs within their states.

How do I make edits in form states military without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your state form military, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How do I edit income test certificate straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing residence form military right away.

How do I edit exemption duty form online on an iOS device?

Yes, you can. With the pdfFiller mobile app, you can instantly edit, share, and sign exemption states military form on your iOS device. Get it at the Apple Store and install it in seconds. The application is free, but you will have to create an account to purchase a subscription or activate a free trial.

Fill out your form states military online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Test Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to dd form state

Related to center contact information

If you believe that this page should be taken down, please follow our DMCA take down process

here

.